Accessing up-to-date and accurate economic information is essential for growth. Keeping informed can help to adapt to trends and make wise decisions.

During the industrial revolution, small businesses transformed into global enterprises. How can one access comprehensive economic information to replicate such success?

High-quality economic insights propel businesses toward innovative growth trajectories and robust financial health – vital for navigating today’s dynamic economic landscape.

Global Economic Trends

In recent years, the global economic landscape has experienced profound shifts driven by technological innovation.

Notably, artificial intelligence and automation are redefining traditional industries, leading to enhanced productivity, reshaped job markets, and the emergence of new economic models. These advancements offer unprecedented opportunities for growth and efficiency, transforming how we perceive economic value and sustainability.

Simultaneously, there is a growing emphasis on greener economies. Increasing environmental awareness has catalysed a shift towards sustainable practices, influencing both consumer behaviour and corporate strategies, ultimately steering global markets towards a cleaner, more sustainable future.

To harness these dynamic trends, acquiring accurate and comprehensive economic information is paramount. Detailed analyses and insights empower businesses and investors to navigate these transitions effectively. For instance, you can get a LEI code here, which facilitates secure and efficient international transactions, crucial for capitalising on global economic opportunities.

Impact of Government Policies on Economy

Government policies significantly shape economic landscapes, steering the direction of growth and development sectors.

By implementing fiscal policies such as taxation and government spending, policymakers influence economic activity, stabilising fluctuations and promoting balanced growth. For example, investments in infrastructure can stimulate employment and economic expansion, fostering a robust foundation for long-term prosperity.

Additionally, government regulations ensure a fair market environment. By monitoring monopolistic tendencies and safeguarding consumer rights, such measures enhance market competition, leading to innovation and improved goods and services.

Moreover, policies promoting education, healthcare, and green initiatives bolster human capital, resource sustainability, and societal wellbeing. This multifaceted approach cultivates resilient economies, prepared to navigate future challenges and seize emerging opportunities, thereby fostering global stability and inclusive growth.

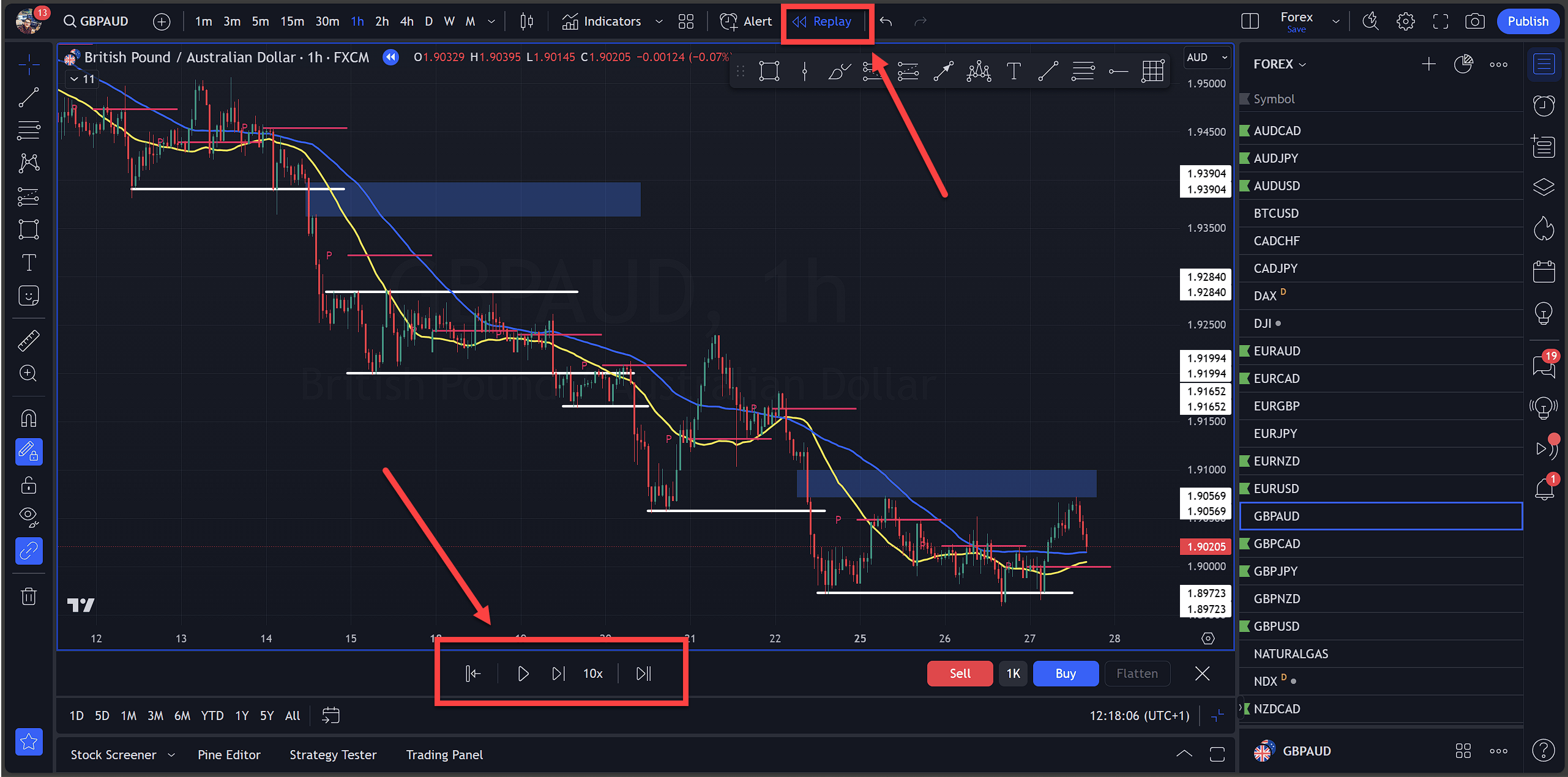

Understanding Market Fluctuations

Market fluctuations significantly impact economic landscapes.

These fluctuations arise from myriad factors, including economic policies. The complex interplay of these forces necessitates keen analysis and adept management to mitigate adverse effects. Consequently, staying abreast of the latest economic information is paramount, enabling stakeholders to anticipate shifts and formulate strategies accordingly.

The essence of market dynamics lies in volatility.

Predicting these dynamics is both an art and a science – undeniably challenging but also immensely rewarding. By comprehensively understanding market patterns, one can harness volatility to achieve favourable outcomes.

As we navigate an era of rapid technological advancement, embracing economic fluctuations with an informed perspective is crucial. This proactive approach not only safeguards investments but also capitalises on opportunities, driving sustained economic growth. For instance, you can get a LEI code here to enhance market transparency and streamline financial processes amidst these fluctuations.

Key Economic Indicators

Several pivotal indicators shape the economic landscape, providing a roadmap for actionable insights. Gross Domestic Product (GDP), inflation rate, and employment levels are among the most scrutinised metrics, each revealing crucial intricacies of a nation’s economic health.

For investors and policymakers alike, these indicators offer a “pulse check” for economic stability. A significant shift in any of these metrics can herald broader economic changes. Thus, understanding the nuances behind these indicators empowers stakeholders to make informed, strategic decisions today and for the future.

GDP Growth Rates

GDP growth rates are paramount in assessing the economic vitality of a nation, reflecting changes in economic output and overall societal wealth. These rates offer critical insights into economic health and are pivotal for strategic planning.

Governments and businesses alike closely monitor GDP growth rates, adapting policies and strategies based on this data. For informed decision-making, consistent analysis of these rates helps in anticipating economic trends and potential disruptions.

The GDP growth rate is a principal measure of economic performance and prosperity.

An upsurge in GDP growth rates often indicates a thriving economy, encouraging investment and innovation, whereas a decline could necessitate corrective measures. By understanding and leveraging these rates, stakeholders can drive impactful economic decisions, fostering long-term prosperity and resilience.

Unemployment Rates

Unemployment rates are crucial indicators of economic stability, reflecting the proportion of the labour force that is actively seeking work but unable to find employment.

Effective policy implementation significantly impacts these rates.

These statistics provide essential insights into the economic conditions, helping to identify areas of concern. Persistent high rates may signify underlying economic issues, necessitating targeted interventions and robust policy adjustments.

To put it into perspective, understanding unemployment rates is not solely about job availability but also about economic health and societal progress. For more comprehensive economic information, including how these rates integrate into broader financial contexts, you can get a LEI code here, aiding in your strategic planning and decision-making undertakings.

Role of Central Banks

Central banks are pivotal in maintaining economic stability through monetary policy control.

Since 2016, central banks, as financial guardians, strategically conducted interventions, thus shaping the global financial landscape and nurturing market confidence.

Indeed, it’s this very role that underscores a central bank’s importance in defining the economic contours and ensuring systemic liquidity, protecting against disruptions.

By managing interest rates, central banks also influence inflation and unemployment, aiming to achieve the mandated objectives of stable prices and full employment, consequently fostering sustainable economic growth.

An in-depth understanding of their functions can empower your economic strategy profoundly.

International Trade and Its Effects

International trade drives global economic progress.

By fostering exchange across borders, international trade broadens market horizons and enhances resource allocation. This interconnection allows countries to specialise in producing goods where they have a comparative advantage, leading to increased efficiency and higher overall production. Consequently, nations can enjoy a higher standard of living and more diversified product offerings.

Globalisation thrives on seamless trade.

However, trade can expose economies to global market fluctuations, necessitating robust economic policies to mitigate potential drawbacks. Balancing trade benefits and protecting local industries remains crucial.

Therefore, understanding the dynamics of international trade and its multifaceted impacts is essential. In alignment with this, accessing comprehensive economic information, such as you can get a LEI code here, is invaluable. This knowledge enables stakeholders to navigate international markets astutely, ensuring resilient and progressive economic development.

Inflation and Cost of Living

Inflation denotes a sustained increase in the general price level of goods, exerting considerable pressure on household budgets, businesses, and economies at large. It signifies eroding purchasing power.

Understanding the underlying causes of inflation is critical.

Rapid inflation can undermine economic stability, while moderate inflation can stimulate growth.

Significant factors include increased production costs, rising demand, and monetary policy.

Moreover, inflation impacts the cost of living, affecting daily expenses such as food, housing, and transportation, thereby influencing standards of living.

Consequently, it’s essential to track inflation’s effects on everyday life. Comprehensive economic information helps in assessing inflationary trends, predicting future impacts, and formulating informed responses.

Investment Strategies During Economic Uncertainty

Navigating economic uncertainties requires strategic, judicious, and agile investments to protect assets and foster growth amid financial volatility.

Firstly, diversifying portfolios to include a mix of asset classes such as equities, bonds, real estate, and commodities, remains an essential strategy. This diversification helps mitigate risks while capturing potential gains across different sectors and markets.

Moreover, maintaining a keen focus on high-quality assets is crucial. Investing in companies with robust balance sheets, stable earnings, and strong market positions can provide resilience and potential for recovery, even in turbulent times.

Finally, it is wise to consider adding a protective layer to investment strategies through instruments such as government bonds and gold. These traditionally safe havens can provide stability during market downturns, complementing more growth-oriented assets. For further insights and resources, you can get a LEI code here.

The Future of Digital Currencies

Digital currencies continue to garner significant attention and interest.

As the financial world evolves, digital currencies manifest as harbingers of transformative change. The inherent advantages lie in their potential to reduce transaction costs, expedite transfers, and provide financial inclusion for unbanked populations. Consequently, nations and corporations alike are exploring the extensive possibilities within digital finance.

Blockchain technology propels these currencies forward.

The decentralised, transparent nature of blockchain offers unprecedented security and trust, creating a fertile ground for digital currency adoption. Harnessing this technology promises to reshape financial systems worldwide, driving efficiency and innovation.

Financial institutions and regulators are keenly observing these developments. While the path ahead is intricately complex, the optimistic trajectory for digital currencies heralds a future of enhanced economic fluidity. The momentum behind this revolutionary shift will undoubtedly shape the paradigms of global commerce and personal finance.

Impact of Technological Advancements on Economy

Technological advancements have catalysed economic growth, driving innovation, efficiency, and productivity across various sectors worldwide. These developments are fundamentally reshaping how businesses operate.

Broadly speaking, technology enhances operational processes, reducing costs and improving service delivery.

Furthermore, emerging technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) are transformative.

Increased connectivity through 5G networks also supports technological growth, enabling seamless communication and data exchange.

Investment in technology not only spurs economic development but also fosters competitive advantage, empowering industries to scale new heights.

Ultimately, the key to thriving in today’s economy lies in embracing change. For more on leveraging technology for economic advancement, you can get a LEI code here.

Sustainable Economic Practices

Sustainable economic practices serve as the cornerstone of future-proofing our global economy.

In 2016, the United Nations’ 2030 Agenda for Sustainable Development provided a well-structured framework to drive growth while preserving ecological balance and promoting social equity.

By incorporating sustainability into economic strategies, businesses can achieve impressive efficiency in resource use, which in turn fosters innovation and long-term profitability.

Moreover, adhering to sustainable principles enhances corporate reputation, attracting investment and facilitating partnerships aligned with ethical and environmental standards.

Prioritising sustainability ensures that businesses are resilient, ready to address global challenges and seize emerging opportunities.

Economic Outlook for Emerging Markets

Emerging markets present a plethora of opportunities, despite the challenges posed by the global economic landscape.

In 2023, several emerging economies, like India and Brazil, exhibited remarkable resilience, showing steady growth amid global uncertainties.

However, it’s not just these nations leveraging economic information for success; smaller markets are also making strides through innovative policies and investments.

Governments and businesses in these regions are focusing on diversifying their economies, encroaching upon new growth sectors to mitigate the risk of dependency on single industries.

This strategic shift has infused renewed vigour, positioning these markets as potential powerhouses on the global stage.

How to Access Economic Information

Economic information is pivotal for businesses to forecast trends, adapt strategies, and achieve sustained growth.

It is essential that businesses access reliable economic information through reputable sources such as international financial institutions, academic journals, and industry reports, which often contain comprehensive analyses and forward-looking insights.

For a streamlined approach, you can get a LEI code here to simplify tracking and utilising economic data effectively.

Using Online Databases

Economic researchers and analysts frequently turn to online databases, which serve as invaluable repositories of economic information, facilitating data-driven decision-making and strategic planning.

These databases offer extensive data on global financial markets.

Additionally, many of these databases provide real-time updates (thus ensuring the relevance of information).

By utilising these resources, businesses can identify emerging trends and forecast potential opportunities and risks.

Among the prominent online databases are Bloomberg, Euromonitor, and the International Monetary Fund’s database, offering specifically tailored insights for various industries and markets.

Thus, not only do these tools democratise access to information, but they also level the playing field. Leveraging comprehensive databases allows businesses to stay ahead of the curve in an ever-evolving economic landscape.

Regular Economic Reports

Regular economic reports serve as a cornerstone in understanding, analysing, and navigating a rapidly changing economic environment, offering a comprehensive assessment of current market conditions.

They provide stakeholders with the necessary insights for strategic decision-making.

Monthly, quarterly, and annual reports review key economic indicators (such as GDP, employment figures) and trends.

These documents help in interpreting macroeconomic dynamics and forecasting future economic activities.

Equipped with such detailed information, businesses can mitigate risks, leverage emerging opportunities, and enhance their competitive position in the market.

Ultimately, the consistent analysis of these reports is vital for achieving sustainable growth. Additionally, you can get a LEI code here for further economic engagements.

Accessing and Understanding Financial News

Accurate financial news informs significant economic decisions.

Regularly accessing financial news provides the latest insights. This news coverage can include analysis, forecasts, commentaries or expert opinions. Diligent perusal of such information empowers businesses and individuals alike to make strategic decisions founded on current economic conditions. Consequently, keeping an eye on emerging trends is indispensable for anyone striving to excel financially.

Remaining updated enhances financial literacy.

Today’s myriad digital platforms offer unparalleled access to high-quality financial news. From mobile applications to dedicated financial channels and respected online portals, the array of information sources ensures there is no shortage of data for informed decision-making.

Coupling this readily accessible financial news with rigorous analysis, professionals and budding economists can strategically navigate evolving economic landscapes. Engaging with comprehensive economic information consistently builds a robust foundation to adapt, innovate, and achieve economic success.

Importance of Legal Entity Identifiers (LEI)

Legal Entity Identifiers (LEIs) hold paramount significance in the global economic landscape, providing a universal standard for identifying legal entities engaging in financial transactions. This unique identification system fosters transparency.

LEIs enhance the accountability of entities within financial markets.

Notably, regulators worldwide insist upon the usage of LEIs, exemplifying their indispensable role in mitigating systemic risk. Instituted post-2008 financial crisis, their adoption was pivotal.

LEIs facilitate the accurate tracking of financial transactions. Furthermore, they aid in the detection and prevention of illicit financial activities, fortifying the integrity of global markets.

Institutions aiming for operational excellence benefit immensely from adopting LEIs, allowing them to seamlessly adhere to jurisdictional compliance. Additionally, LEIs streamline administrative processes by offering a simplified, consistent identification mechanism.

Innovatively, the burgeoning demand for LEIs highlights their crucial place in today’s financial system. To join the myriad entities leveraging this robust tool, you can get a LEI code here.