When you’re diving into the world of trading, you’ll come across many complex terms and strategies. One important concept to grasp is backtesting trading strategies. But don’t worry if you’re new to this; we’re going to break it down in a way that’s easy to understand, even if you’re just starting out or if you’re explaining it to a young learner.

What is Backtesting?

Backtesting is like a practice run for your trading strategies. Imagine you have a new idea for how to trade stocks, but you’re not sure if it will work. Instead of trying it out in the real market right away, you use past market data to see how your idea would have performed. This process of testing your strategy against historical data is called backtesting.

Why is Backtesting Important?

Think of backtesting as a way to practice before a big game. Just as athletes train to improve their performance, traders use backtesting to test their strategies and find out if they could potentially be successful. It helps traders see if their ideas are likely to make money or if they need some tweaking.

How Does Backtesting Work?

Backtesting involves several steps:

- Develop a Trading Strategy: First, you need to come up with a clear idea of how you want to trade. This might involve certain rules or criteria that guide when to buy or sell a stock.

- Collect Historical Data: Next, you gather data from the past. This data includes information about stock prices, trading volumes, and other market conditions.

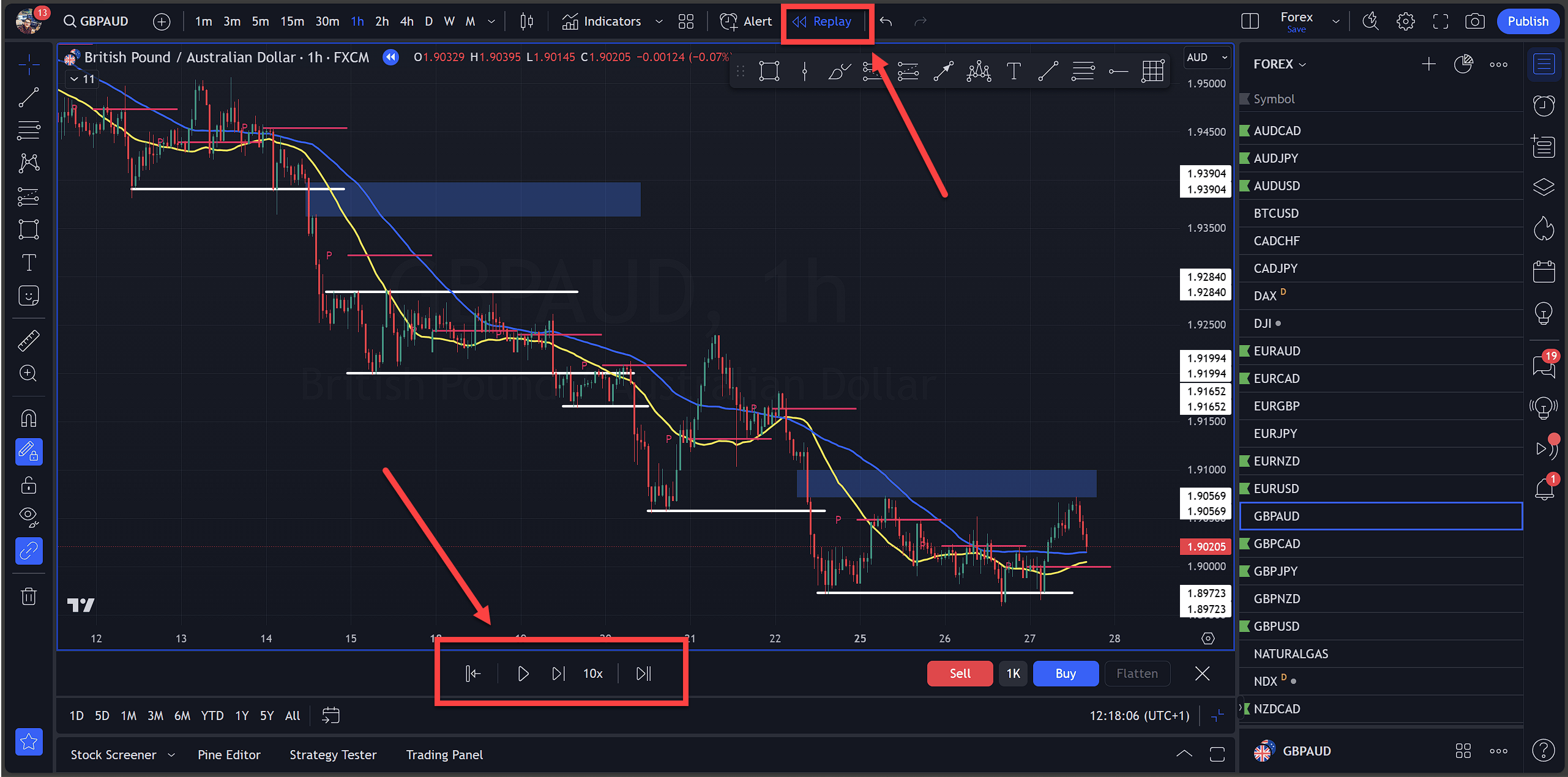

- Test the Strategy: Using the historical data, you apply your trading rules to see how they would have performed in the past. This is done using special software or tools designed for backtesting.

- Analyze Results: After testing, you analyze the results to see how well your strategy would have done. You look at things like profits, losses, and how often the strategy made successful trades.

- Refine Your Strategy: Based on the results, you might need to make changes to your strategy. If the backtest shows that the strategy isn’t working as well as you hoped, you adjust it and test again.

Tools and Software for Backtesting

There are several tools and software available that can help you with backtesting. Some popular options include:

- Trading Platforms: Many trading platforms come with built-in backtesting features. These platforms allow you to test your strategies using their historical data.

- Excel: For those who prefer a hands-on approach, Excel can be used to perform basic backtesting. It involves creating spreadsheets to track your trading rules and results.

- Specialized Software: There are also specialized backtesting software and programs designed for more advanced users. These tools often provide more detailed analysis and more extensive historical data.

Key Concepts in Backtesting

To make the most of backtesting, it’s helpful to understand some key concepts:

- Historical Data: This is the past market information that you use to test your strategy. The more data you have, the better you can understand how your strategy performs under different market conditions.

- Performance Metrics: These are the measures used to evaluate how well your strategy worked. Common metrics include profit and loss, win rate, and maximum drawdown.

- Optimization: This refers to adjusting your strategy to improve its performance based on the backtesting results. It’s like fine-tuning your approach to get better results.

- Overfitting: Be careful not to make your strategy too specific to past data. Overfitting happens when a strategy works perfectly with historical data but fails in real trading. It’s important to ensure your strategy is robust and adaptable.

Common Mistakes in Backtesting

Even though backtesting is a powerful tool, there are common mistakes that traders should avoid:

- Using Incomplete Data: Make sure you use comprehensive historical data. Missing data can lead to inaccurate results.

- Ignoring Real-World Conditions: Remember that past performance doesn’t always predict future results. Real-world factors like market news and economic events can impact your strategy.

- Over-Optimizing: Avoid tweaking your strategy too much to fit past data. This can make your strategy less effective in real trading.

Conclusion

Backtesting trading strategies is an essential step for any trader who wants to improve their chances of success. By practicing with historical data, you can test your ideas, refine your approach, and build confidence before diving into real market trading. Remember to use reliable tools, understand key concepts, and avoid common mistakes to make the most of your backtesting efforts.